BullTribe broker review: what do traders say about the company?

BullTribe brokerage company is attracting the attention of customers. Some reviews about the company can be negative. Let’s understand why this happens and what problems can arise when working with BullTribe.

BullTribe broker reviews

Inaccurate information

Information about the BullTribe broker is considered unreliable if the data does not coincide with its real actions.

The main signs of withdrawal problems include delays or refusals without objective reasons.

Poor quality of service is manifested through inadequate response to requests and complaints, as well as ineffective problem solving.

To verify information, it is useful to study user reviews, ratings, and BullTribe’s policies.

Withdrawal problems

Withdrawal problems at BullTribe can create difficulties for customers.

Some Louis Bull Tribe users may experience restrictions when withdrawing money from their accounts.

This can lead to frustration and inconvenience in the financial market.

For market professionals and residents of Maskwacis, Alberta, this can be a real problem.

However, BullTribe is taking steps to address these issues.

The BullTribe team takes into consideration the opinions of veterans, first responders and front line medical staff.

They support traditional and non-traditional therapies as well as accepting donations that are tax deductible.

The organisation also supports landmark programmes for families and communities struggling with suicide.

It provides assistance through a national suicide hotline and crisis line.

All of this is done to support members of the community and ensure they have access to critical resources.

Poor customer service

Clients may experience problems receiving support and information from BullTribe.

Inadequate feedback and delays in processing requests can cause frustration.

Poor service can lead to a loss of trust and a search for alternatives.

Lack of diversity in services and lack of support for different customer groups are also important.

To improve service quality, BullTribe can:

- Improve technological solutions.

- Offer more traditional and non-traditional therapies.

- Strengthen the charitable mission.

Developing community support, family support and suicide intervention programmes will also help improve client satisfaction and service quality.

Clients talk about their experience with BullTribe

Opacity in broker’s work

Lack of transparency in a broker’s operations has a negative impact on clients’ trust in the company. When clients do not receive enough information about a broker’s financial operations or strategies, it can cause distrust and doubt. Hidden information can lead to wrong decisions, missed opportunities in the financial market and even loss of funds. It is important for clients to have access to transparent data and clear explanations of processes in order to have confidence in their broker.

At BullTribe, customer support and financial transparency are at the core of operations. A team of professionals from the financial markets focuses on providing transparent information and support to each client to create trustworthy relationships and provide successful financial solutions.

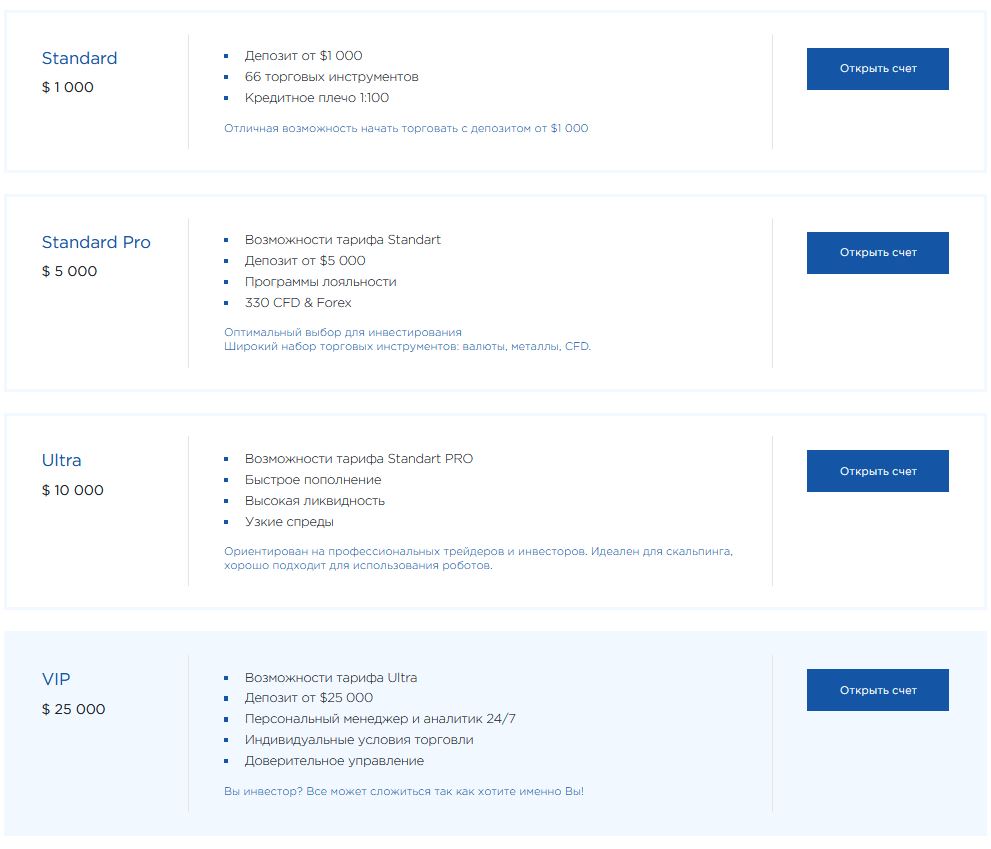

High commissions and hidden fees

BullTribe clients have expressed complaints about high commissions and hidden fees. They want more clarity and lower costs.

For example, some customers have discovered hidden fees in the BullTribe app. This has caused dissatisfaction.

To improve the situation, BullTribe provides information about all transactions and pricing.

The broker offers a choice of rates with different commissions. It also helps customers to understand the financial market.

BullTribe is working to improve services and customer satisfaction.

Lack of responses from BullTribe representatives

Customers are not getting answers from BullTribe. This is because of the weak support system, without help customers find it difficult and this causes dissatisfaction. The company should improve the support system and train the employees better, improve communication, manage enquiries more effectively. BullTribe should show willingness to improve the support. This will help build trust with customers.

Questionable actions of the broker

Refusal to pay out winnings

Customers may complain about winnings being denied for a variety of reasons. This may be due to the need for additional identity verification or failure to fulfil the terms and conditions of the user agreement.

BullTribe takes actions to prevent such situations. For example, it improves the verification process and ensures transparency of the terms and conditions of the game.

If a payment denial has occurred, the company seeks a solution. This may include contacting customer support and conducting additional checks.

BullTribe also provides various ways to help and support. Including tax deductible donation opportunities and programmes to combat suicide and raise awareness in the community.

Market Manipulation

A BullTribe broker may engage in unfair market behaviour. For example, it may raise stock prices inappropriately, create false trading volumes, or give false information.

This can confuse other investors and confuse customers, subsequently affecting their investments and finances. To prevent such behaviour, BullTribe must take action.

For example, it is important to monitor market operations, train employees on ethics and the law, and impose strict rules and penalties for violators.

Thus, the broker should strive for transparency and honesty in the financial markets, fighting manipulation and protecting clients’ interests.

Unreasonable demands to clients

The BullTribe broker requires the use of the Louis Bull Tribe app for all customers, including veterans, medical personnel, and community members.

This may violate customers’ data privacy due to the app’s access to their personal information and contacts.

Clients cannot choose between traditional and non-traditional treatments as they must consent to all.

Donations made under these requirements are considered tax deductible, causing clients to question the mission of the non-profit organisation.

These actions alienate clients and undermine their trust in BullTribe, which can negatively impact their supportive environment and systems of care.

Results of BullTribe’s privacy policy analysis

Disclosure of customers’ personal information

BullTribe may disclose customer data, such as email addresses, telephone numbers and financial information, without customer consent.

To protect customers’ personal information from unauthorised access, the company uses data encryption and has a privacy policy.

BullTribe customers have the right to privacy of their data and can manage their privacy settings and opt out of certain types of data processing.

Selling data to third parties

Third party data may contain information about BullTribe customers. This information may include customer preferences, purchases, and personal data.

This data may be shared with third parties without customer consent. The sale of data is subject to a privacy policy.

The Privacy Policy clearly defines what data can be shared and for what purpose.

To protect customer data from unlawful use, BullTribe takes various security measures.

These measures include encrypting data, using passwords, and restricting access to sensitive information.

Why do clients leave negative reviews about BullTribe broker?

Clients leave negative reviews about BullTribe broker because of delays in withdrawal of funds, inadequate customer support and non-transparent commissions. For example, they wait a week to withdraw money, support does not respond, and commissions are not specified on the website.

What are the main problems BullTribe clients experience?

BullTribe customers’ problems include long waits for support response, difficulty interacting with the platform interface and insufficient information about new products and promotions.

Are there any cases of fraud on the part of BullTribe broker that customers write about?

Yes, there are cases of fraud by BullTribe broker that clients have written about. Examples include delayed withdrawals, failure to fulfil promised terms of trades and lack of customer feedback.

What is BullTribe’s response to negative feedback from its customers?

BullTribe responds to negative customer feedback by analysing the problem, liaising with the customer to find out details and providing possible solutions. Example: the company promises to replace a product if the customer is not satisfied with the quality.

Are there ways to resolve conflicts between customers and BullTribe broker?

Yes, ways to resolve conflicts include contacting BullTribe’s customer support department via email or phone. Customers can also contact the Financial Ombudsman for independent dispute resolution.